The Morrison Government has announced some welcome relief for retirees, income support recipients, casual workers and sole traders in the face of deteriorating economic impacts of the coronavirus pandemic.

- Minimum pension halved

- Deeming rates cut further

- 2nd $750 economic support payment

- $550 pf Coronavirus Supplement

- $10,000 super hardship withdrawal

Temporarily Reduce Minimum Superannuation Pension Drawdown

Retirees will have more flexibility as to how they manage their superannuation assets due to the ability to reduce minimum superannuation pension drawdowns by 50% for the current financial year (2019-20) and in the next financial year (2020-21).

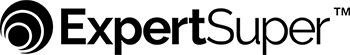

The table below illustrates the current and temporarily reduced minimum drawdown rates for account based pensions, noting that the measure also applies to other types of super pension.

Depending on income needs, this allows retirees to suspend monthly or quarterly payments for the remainder of 2019-20; reduce monthly or quarterly payments for the remainder of 2019-20 and all of 2020-21; or halve annual payments normally made in June for this financial year and next.

Please speak to your adviser if you wish to amend your payment arrangements.

Social Security Deeming Rates Cut

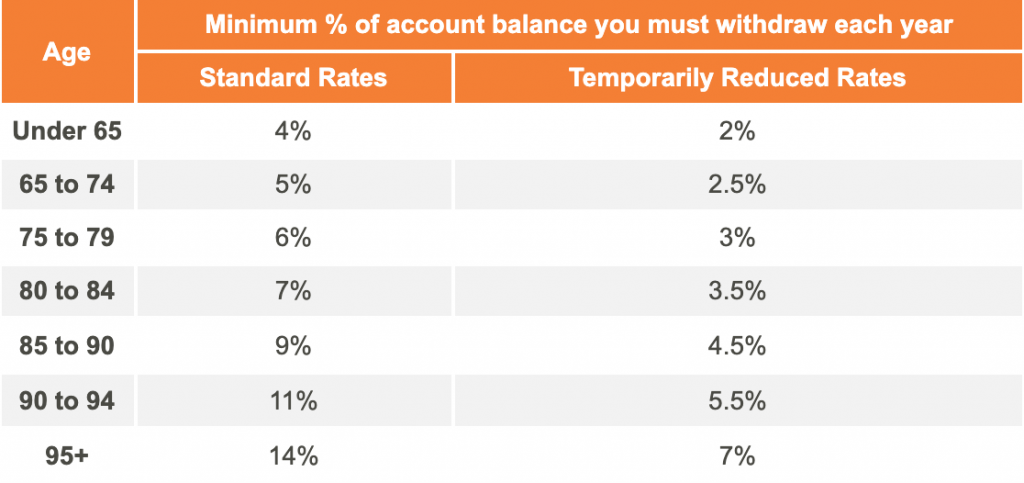

To reflect the latest RBA rate reductions, the Government is further reducing the deeming rates applying to financial assets under the Centrelink means tests for income support payments.

The below table illustrates the asset levels at which the two deeming rates apply to singles versus couples:

The new lower rates apply from 1 May 2020.

A second $750 economic support payment

In addition to the $750 stimulus payment announced on 12 March 2020 and due to be paid from 31 March 2020, a further $750 economic support payment will be made from 13 July 2020 to Social Security and Veterans’ Affairs income support recipients and eligible concession card holders.

Those receiving an income support payment (eg JobSeeker Payment) eligible for the $550pf coronavirus supplement (below) do not receive the second economic support payment.

Expanded Income Support Criteria and $550 Coronavirus Supplement

The Government is temporarily expanding eligibility and qualification criteria for income support payments (JobSeeker Payment, Youth Allowance JobSeeker, Parenting Payment, Farm Household Allowance and Special Benefit) for the next six months.

The expanded criteria is designed to assist Sole Traders and Self-employed people, and those caring for someone infected or in isolation as a result of contact with Coronavirus.

The Government will provide a temporary Coronavirus Supplement of $550pf for six months to people receiving the abovementioned benefits.

Early Release of Superannuation

Individuals including Sole Traders suffering financial hardship due to the COVID-19 pandemic will be able to access $10,000 from their super in the current financial year before 1 July 2020 and a further $10,000 in the next financial year from 1 July 2020 for another three months.

The amounts released will be tax-free and will not affect Centrelink or Veterans’ Affairs payments.

Treasurer Josh Frydenberg indicated that those eligible to receive the Coronavirus Supplement, as well as sole traders or casual workers whose income has fallen by 20% or more as a result of the coronavirus, will be eligible to apply by completing an online declaration via their my.gov.au account.

What to do?

If you’d like further information on the above measures, please contact us.

The information in this article contains general advice and is provided by ExpertSuper™ Pty Ltd as an authorised representative of Primestock Securities Ltd AFSL 239180. That advice has been prepared without taking your personal objectives, financial situation or needs into account. Before acting on this general advice, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should obtain and read the Product Disclosure Statement (PDS) before making any decision to acquire any financial product referred to in this article. Please refer to the FSG (available here) for contact information and information about remuneration and associations with product issuers.This information should not be relied upon as a substitute for professional advice, and we encourage you to seek specific advice from your professional adviser before making a decision on the matters discussed in this article. Information in this article is current at the date of this article (3 Apr 2019) and we have no obligation to update or revise it as a result of any change in events, circumstances or conditions upon which it is based.